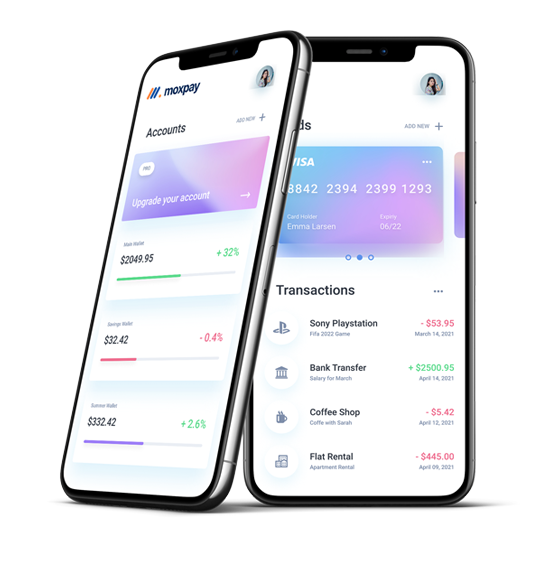

Helping You Make Smart Financial Choices

Making payments simple, secure, and right for you.

Smart choices start with Seamless Transactions

TPIPAY

Smart Fintech Solution for Your Business

Payment Methods

Integrate multiple payment options, including credit/debit cards, ACH transfers, and Digital wallets.

Mobile Recharge

Our software platform provides seamless mobile and DTH recharge services, supporting all major operators across India.

BBPS

Implement multi-party payouts using API-driven split settlements, escrow management, and automated fund distribution.

Account Opening

Simplify customer onboarding with our innovative, streamlined, and paperless account opening solutions.

AEPS

Our AEPS solution allows businesses to offer essential banking services such as cash withdrawals, balance inquiries, and mini statements using Aadhaar authentication.

Secure Transactions

Protect every transaction with advanced security measures and fraud prevention Tools.

e-Wallet

Enable fast and convenient payments with popular digital wallets like Apple Pay and Google Pay.

Payin & Payout API

Transfer funds to employees, vendors, or customers through NEFT, IMPS, UPI, and RTGS.

Why Choose Us

Retailers -beloved banking platform.

Innovative Fintech Solutions

Easy to Setup

Set up your payments quickly and easily, no complicated steps Required.

Secure Transactions

Keep every payment safe with advanced encryption and fraud Protection

24/7 Support

Get expert help anytime, anywhere with our 24/7 Support.

What we offer

Connecting all your banking needs.

Incorporate All Your Business Banking in One Platform – TPIPAY

FAQ

Frequently Ask Questions

Got questions? We’ve got answers—check out our FAQs for quick and Easy Help.

Global Question

Yes, our platform supports multiple currencies and cross-border transactions with secure processing.

International payments may be subject to currency conversion fees and cross-border transaction charges. Check our pricing details for specifics.

We support a wide range of global currencies. You can enable multi-currency transactions based on your business needs.

Currency conversion is processed automatically at real-time exchange rates, with minimal conversion fees applied.

Yes, we use encryption, tokenization, and fraud detection tools to ensure secure international payments.

Yes, you can set geographic restrictions and block transactions from specific regions to match your business preferences.

Product Information

BBPS (Bharat Bill Payment System) is a one-stop solution for paying utility bills like electricity, gas, water, DTH, and more in a secure and standardized way.

AEPS (Aadhaar Enabled Payment System) allows users to withdraw cash using their Aadhaar number and biometric authentication without needing a debit card.

Yes! By integrating a recharge API, your platform can enable seamless mobile and DTH top-ups for users.

Payin refers to money coming into an account (like customer payments), while Payout is money going out (like vendor payments or salary disbursals).

Payout times vary by payment method but typically range from 1 to 3 business days for most transactions.

Fintech platforms use encryption, multi-factor authentication, and regulatory compliance to ensure transactions are secure and fraud-free.

Trusted by 25,000+ world-class brands and organizations of all sizes

Unlock the future of digital transactions with TPIPAY’s fast, secure, and scalable payment solutions. Whether you’re running an eCommerce store, a subscription service, or a marketplace, our advanced payment infrastructure ensures smooth and reliable transactions every time.

Start using TPIPAY today

The Smart Way for Online Payment Solution.